Crypto for Nonprofits: How to Accept Crypto Donations

.jpg)

Roughly 65 million Americans own cryptocurrency, and this number is only growing, as the global market capitalization has increased by a trillion dollars since 2021. In short, crypto donations hold massive potential for nonprofits.

So why do so few nonprofits take advantage of these gifts?

Many organizations neglect to prepare for crypto donations because they want to focus only on the most pressing tasks. However, accepting crypto donations isn’t just about one-time asset gifts; it’s about increasing your organization’s appeal to the highest-capacity, most tax-savvy, and legacy-minded donors.

If you want to prepare your nonprofit for the future of giving, it’s time to take action.

In this guide, we’ll cover everything you need to know to tap into cryptocurrency donations:

- The Basics of Crypto for Nonprofits

- Benefits of Accepting Crypto Donations

- How to Accept Crypto Donations

- The Donor Perspective on Crypto Fundraising

- Checklist for Accepting Cryptocurrency Donations

- Crypto for Nonprofits FAQ

- Start Tapping Into Crypto for Nonprofits

Once you start accepting crypto, you’ll open the door to all kinds of high-impact non-cash gifts. Let’s start with the basics so you can build a strong foundation for asset giving.

.png)

The Basics of Crypto for Nonprofits

What is cryptocurrency?

Cryptocurrencies are digital currencies that are transferred online and aren’t regulated by a government or financial institution. This makes crypto a global, peer-to-peer currency that can change quickly in market value. The most common cryptocurrencies are Bitcoin and Ethereum, but several others are also rising in popularity.

Cryptocurrencies utilize blockchain technology for transparent transaction recording. Each transaction is recorded as a data block, which joins a chain of previous blocks, creating the “blockchain.” This blockchain is immutable, meaning no piece can be altered or deleted, which makes every transaction transparent and tamper-resistant.

Remarkably, a substantial portion of the global population engages with cryptocurrency, though it hasn't replaced traditional fiat currencies. Instead, it coexists with fiat currencies, actively used by over 800 million people worldwide.

What are cryptocurrency donations?

Like traditional donations, crypto donations are tax-deductible charitable contributions. Donors can deduct the full value of their gift at the time of donation and avoid capital gains taxes on appreciated crypto.

It’s important that your nonprofit converts donated crypto to cash immediately so that its value doesn’t change after you receive the donation. This way, you can accurately gauge your fundraising progress and have a clear picture of your organization’s finances. Specialized software, like crypto donation platforms, facilitates the collection of these donations by converting them promptly into cash.

Why is crypto philanthropy on the rise?

According to the 2025 State of Nonprofit Asset Gifts Report, although donations are down since the 2020 pandemic, the popularity of non-cash gifts like crypto donations have grown tremendously in popularity over recent years. From 2020 to 2024, the number of Forbes’ Top 100 U.S. Charities accepting crypto donations increased from 12% to 56%, and by the end of 2024, that number grew to 70%.

There are a number of reasons why crypto donations have had such precipitous growth:

- “New money” donors: The growing crypto market has created a new class of donors. The value of Bitcoin has increased dramatically over the past few years, with the current value totalling over $110,000. This means that early investors who have seen their holdings multiply may be looking to put their new wealth toward a good cause like yours.

- Tax benefits: When donors make a gift of appreciated cryptocurrency, they can avoid capital gains taxes and claim a typical charitable deduction. Many crypto users view donations as a crucial part of their end-of-year tax optimization strategy, so appealing to these donors is crucial.

- Streamlined tech: Crypto donation platforms enable any nonprofit to easily accept crypto donations without dealing with complicated logistics or delays. As a result, the size and frequency of crypto donations keep growing. In 2024, nonprofits received over one billion dollars in crypto donations, with the average gift size surpassing $10,000.

.png)

What are the risks of accepting cryptocurrency donations?

When nonprofits begin to consider accepting crypto donations, there are a few concerns that frequently come to mind. You or your board members may worry about:

- Market volatility: Cryptocurrency isn’t regulated by any government, which means its value can change very quickly. That’s why it’s important to convert any crypto donations you receive to fiat (USD) immediately. That way, you’ll secure a gift’s value at the time of donation.

- Longevity: Some nonprofits wonder whether cryptocurrency is a passing fad. However, the continued growth of crypto—both in terms of users and value—suggests otherwise.

- Data privacy concerns: This is a common worry, but understanding and communicating the privacy features of crypto donation platforms can mitigate the concerns surrounding donor data privacy.

- Environmental impact: While there is truth to these concerns, many projects have been actively improving their technology to be more efficient and less harmful. For example, Bitcoin's Lightning Network and Ethereum's 2.0 merge significantly improved efficiency and reduced environmental impact

Considering the risks associated with accepting crypto donations is only responsible, but you shouldn’t let these concerns prevent you from taking advantage of the potential of crypto donations. Instead, invest in crypto donation tools that simplify the process and create consistent, sound policies for processing these gifts.

Benefits of Accepting Crypto Donations

The reason so many nonprofits have begun to accept and encourage crypto donations is because of their many advantages. When you embrace the potential of crypto donations, you can:

.jpg)

Earn Larger Donations

Crypto donors are uniquely positioned to give generously because many came into wealth rapidly during market surges and want to channel that success into meaningful causes. They’re also highly motivated by tax efficiency, since donating appreciated crypto allows them to avoid capital gains taxes in addition to claiming a charitable deduction.

As a result, the average crypto donation is a staggering $10,000. For reference, the average online cash donation pales in comparison at an average of ~$120. By adding the option to donate cryptocurrency, your organization gains a new revenue stream that could generate these large gifts at any time.

Access New, High-Value Donors

Cryptocurrency opens the door to a donor base that many nonprofits struggle to engage: younger, tech-savvy generations. Millennials and Gen Z make up the majority of crypto users, and they’re eager to use their wealth to support causes that align with their values.

Importantly, many in this group are also high-income earners or investors, looking for ways to factor philanthropy into their personal financial growth. Stock and crypto donations can save donors more than 30% in capital gains taxes while providing a deduction for the full fair market value, making them the perfect tax-efficient way to give. By offering the opportunity to donate crypto, you can engage these groups more effectively.

Keep Up With the Future of Fundraising

Accepting cryptocurrency sends a strong message that your nonprofit is innovative, adaptable, and future-ready. Since many organizations are still hesitant to adopt crypto donations, you can differentiate yourself by taking the plunge. For stakeholders, seeing your willingness to experiment with new giving channels builds confidence that you’re strategically thinking about long-term sustainability.

The benefits of cryptocurrency donations go beyond simple novelty or the donations themselves. Embracing non-cash contributions now will help secure your nonprofit’s stability in the long run and expand your support network.

.png)

How to Accept Crypto Donations

There’s a common misconception that accepting crypto donations is excessively complicated or difficult for nonprofits. This isn’t true! With the right tools in place, the process is quite simple:

.jpg)

Choose a Crypto Donation Platform

To accept crypto donations efficiently and provide your donors with a seamless donation experience, you first need to find the right tools.

Research crypto donation platforms and consider which one would be the most beneficial for your organization. Look for a provider that will open a crypto wallet for you, automatically convert crypto donations to cash, and transfer the gifts to your account so you don’t have to.

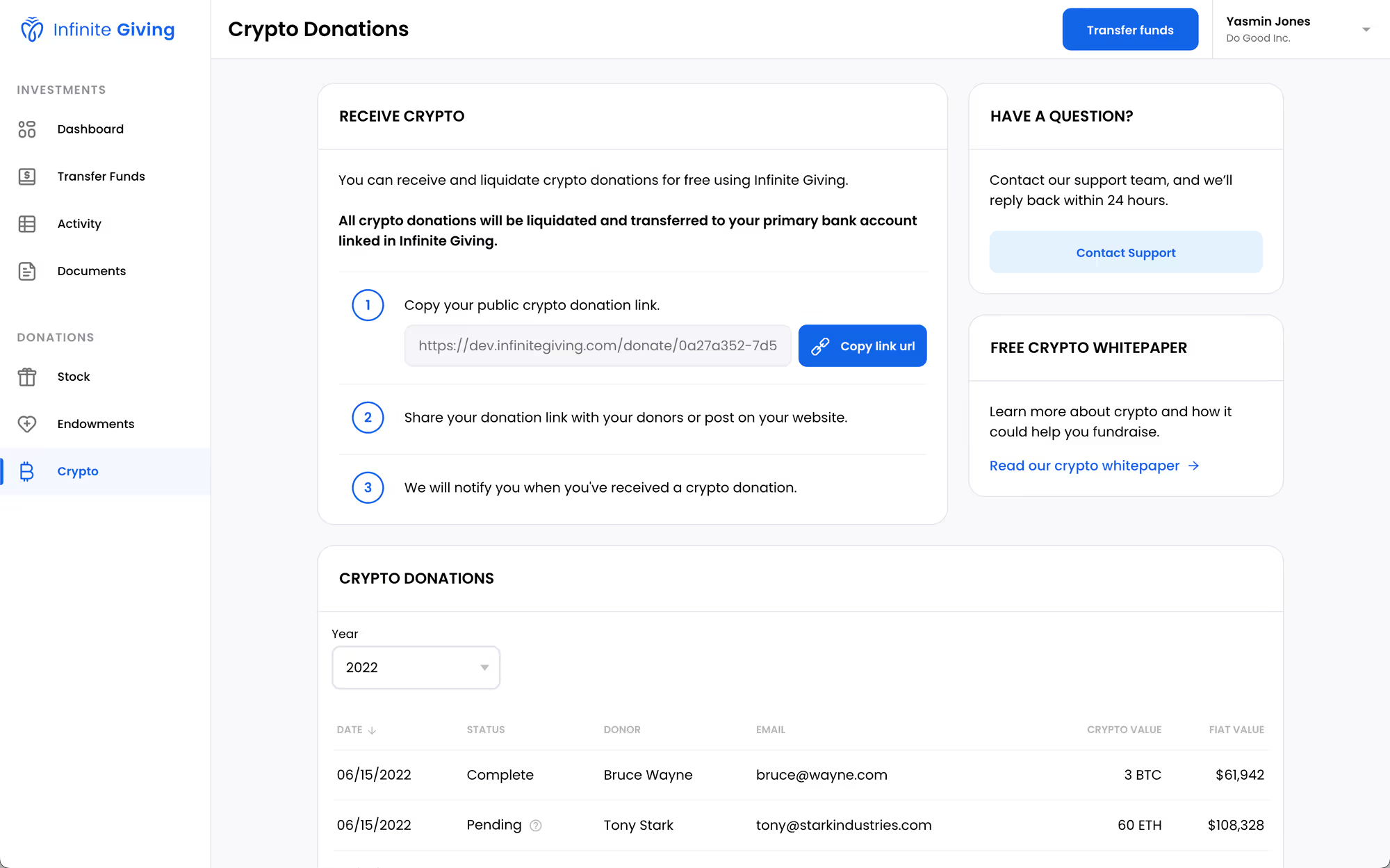

Infinite Giving simplifies the donation process for all kinds of non-cash giving, including crypto donations. Here’s how it works:

- You share your giving link with donors. We provide you with a giving link and wallet QR code that you can add to your donation page. From here, donors simply click or scan the code to make their donation.

- The platform automatically converts the crypto to USD. After receiving a donation, Infinite Giving immediately converts it from crypto to cash and sends your donor an accurate tax receipt.

- Funds arrive in your nonprofit’s account. The platform transfers the cash funds to your organization’s bank account. You receive the full market value of the crypto donation at the time of conversion and don’t have to worry about market volatility.

We make the donation process easy for both your organization and your donors. Additionally, you can view a record of all crypto donations from an intuitive dashboard within the platform, allowing you to monitor your fundraising progress.

2. Add Crypto to Your Donation and “Ways to Give” Pages

Highlight the benefits of crypto donations on your website and provide clear navigation that helps donors make crypto gifts quickly and easily. This ensures that users understand why donating crypto is a good option for them and makes it more likely that they’ll follow through with a donation.

If you use Infinite Giving’s donation platform, you’ll get a branded, flexible donation page with a “More Ways to Give” tab that includes crypto, stock, donor-advised fund (DAF) grants, and endowments. This simple prompt inspires donors to consider alternate forms of giving, and it streamlines the process significantly. Take a look!

.jpg)

3. Establish crypto fundraising policies.

As your organization starts accepting non-cash donations, you should ensure that everyone on your team is on the same page about best practices for minimizing risk and acting ethically. That starts with your internal policies.

Update your gift acceptance policy (or create a new policy altogether) for accepting crypto donations. Like an investment policy statement, these guidelines help protect your nonprofit, its board, and its finances. In fact, the IRS considers crypto and stock identically, which means that if you already have a stock gift acceptance policy, it will often translate very well to a crypto gift acceptance policy.

Here are some key considerations to take into account when designing your policies:

- Liquidation: As discussed, crypto’s value can be volatile. To reduce the risk of a donation suddenly losing value, your policy should emphasize that your organization will liquidate all crypto gifts immediately to secure their USD value.

- Tax receipts: Your nonprofit should issue donation receipts by providing a standard written acknowledgement of the donation, but there are also more specific requirements for crypto donations. You must fill out IRS Form 8282, providing details of the liquidation (acknowledging that you have converted the cryptocurrency to cash within three years of accepting it), and, if applicable, signing Part V of the form to declare that the gift’s value exceeds $5,000. You also must report crypto donations as non-cash contributions on Schedule M of your annual Form 990.

- Anonymity: Many crypto users prefer to remain anonymous when they donate to your organization. However, anonymous donations can come with ethical and logistical issues. Your organization may feel uncomfortable accepting anonymous donations above a certain threshold, and you’ll need some donor information for tax compliance. Outline standards for anonymous donations and create policies to encourage donors to share their information by reminding them of your donor privacy policy.

It’s a good idea to work with an accountant or advisor on these policies to ensure you’re covering all of your bases and protecting your organization from potential risk.

4. Get your team up to speed on crypto for nonprofits.

Some members of your team may harbor concerns or hesitation about getting involved with crypto. Don’t be afraid to have open discussions about the pros and cons of accepting crypto donations, and factor your nonprofit’s tolerance for risk into your crypto gift acceptance policy.

The best way to combat anxiety around crypto is with information. Share statistics on crypto’s popularity and potential, and make sure everyone is on the same page about your gift acceptance policies. Help your staff and board members understand non-cash donations and their immense benefits for your organization.

5. Promote cryptocurrency donations.

Even if a donor owns cryptocurrency, they may not be aware that they can donate it to your nonprofit or what the benefits are. This makes it crucial to create a thorough marketing plan once you start accepting crypto donations.

Use multiple communication channels to spread the word about your new donation option, and emphasize the benefits for donors. For example, you might do one or all of the following:

- Send a text announcement letting donors know that you now accept crypto donations.

- Create a page or blog post on your website that highlights the new giving option.

- Conduct individual outreach to donors you think may be interested in donating crypto based on their giving habits and capacities.

- Design social media infographics that explain the benefits of donating cryptocurrency and the steps to donate crypto to your nonprofit.

- Shine the spotlight on your donors who give cryptocurrency on social media or in your regular email newsletter.

You can also highlight cryptocurrency donations within your marketing materials for other fundraising campaigns. For instance, you might post a short video about how to donate cryptocurrency during your GivingTuesday campaign.

The Donor Perspective on Crypto Fundraising

As your nonprofit sets its sights on crypto donations, it will be helpful to understand crypto users’ demographics and motivations in order to better appeal to these potential supporters. Let’s start by reviewing some basic statistics about the average crypto user:

- Age: The largest age group in crypto is 25-34, representing 31% of total users. Because this group is younger than the average donor, your nonprofit will have to find creative ways to engage a younger audience. Investing in connections with crypto users now can mean decades of support for your cause.

- Gender: As of 2025, about 61% of crypto users are men, 36% are women, and 3% are nonbinary. The male lean of crypto donors is unique because when it comes to conventional cash gifts, women tend to be more philanthropic than men.

- Income: The largest income range group in crypto is those earning $50,000-$100,000, comprising 29% of all users.

These statistics provide a helpful picture of the average crypto donor, but avoid pigeonholing potential donors based on these demographics. As the user base of crypto grows, it becomes harder to create a single profile. It may be more helpful to understand the benefits of donating crypto so you can understand and appeal to donor motivations:

- Tax efficiency: As previously mentioned, donors receive multiple tax benefits from donating crypto. They can file for the typical charitable deduction, and they can avoid capital gains taxes that would take effect if they liquidated their crypto and then donated the same amount of money—potentially saving over 30%.

- Increased impact: Because many crypto users have seen the value of their investment increase dramatically, supporters can donate more than they originally paid for the crypto. This allows them to increase their impact without spending more on a donation.

Understanding crypto donors is the first step to attaining their support. Ask yourself how your communications can appeal to this group and how you can maintain relationships with these high-value supporters.

Checklist for Accepting Cryptocurrency Donations

To start accepting crypto donations, you need to make sure you have the right tools in your toolkit. Use this checklist to ensure you’re ready:

.jpg)

- Crypto wallet: A crypto wallet is a digital tool for sending and receiving funds. It provides private and public keys; your public key is the one you’ll use to receive crypto donations.

- Crypto donation tool: A crypto donation tool, like Infinite Giving’s platform, makes accepting and soliciting crypto donations easy by incorporating crypto giving into your existing donation page. You can also view all of your crypto donations on one dashboard, giving you insight into your non-cash gifts.

- Updated gift acceptance policy: Ensure everyone on your team is on the same page about your guidelines surrounding liquidation, tax receipts, and anonymity.

- Educational resources for staff and donors: Provide one central document where you include information on crypto, dispel common misconceptions, and share how your organization plans to handle and use crypto donations.

- Marketing plan: Because crypto users are a distinct audience with different demographic breakdowns and interests than typical cash donors, you’ll need a dedicated marketing plan to hone your ability to appeal to these donors.

If you don't have everything on this list yet, don't worry. Partner with Infinite Giving to get a crypto wallet, all-inclusive donation tool, and long-term financial management support.

.png)

Crypto for Nonprofits FAQ

What are the different types of cryptocurrency?

There are thousands of different cryptocurrencies, with the most popular ones being Bitcoin and Ethereum.

Why do people use cryptocurrency?

Crypto has surged in popularity because it’s a peer-to-peer currency not tied to any centralized financial institution. These currencies have low fees and provide great functional value using blockchain technologies. In general terms, it is a currency that is used worldwide and has many improvements over a cash system. If you think about crypto as a global form of currency, the value will seem more obvious.

Should we set up a separate bank account for our crypto wallet?

No, there is no need to create a separate bank account. Simply set up a wallet with an exchange or use a crypto donation tool like Infinite Giving to generate and manage the wallets for you. Then, you can link them directly to your regular checking account.

How do we know what type of wallet to select?

You should use a custodial wallet provided by a crypto exchange, like Coinbase or Gemini, so you can easily convert crypto to cash and transfer it to your bank account. Most providers, like Infinite Giving, partner with one of these exchanges on your behalf to make the process easier.

When is it best to sell a crypto donation?

We recommend you sell crypto immediately upon receiving it to avoid potential losses due to market volatility.

At Infinite Giving, we serve as your fiduciary and are required to have your best interests in mind at all times. Thus, we do not allow our clients to hold or buy crypto, just receive it. There is significant value, but it is volatile over the short and long term. If you're looking to invest nonprofit reserves to grow funds, we recommend a low-risk diversified portfolio of stocks and bonds instead of investing in crypto.

How do we get our board to agree to accept crypto if we have an intermediary that would prevent us from actually holding onto the crypto?

Some people aren't yet comfortable using a third-party service that manages crypto for them. It is a tradeoff between convenience (a custodian managing funds for you) and control (you managing your own crypto wallet and private keys). The U.S. government has been making progress to establish better regulations to govern custodians.

When creating a gift acceptance policy for cryptocurrency, should we establish a minimum amount? What are the pros and cons?

The average crypto donation size in 2024 was above $10,000. Since crypto donors typically give more, you could set a minimum donation amount. However, the best crypto donation tools should work easily for you regardless of donation size. You should not need to pay a subscription fee or anything up front to receive crypto gifts. That way, minimums become a non-issue. You do not need to pay to play.

What fees are associated with accepting cryptocurrency?

It depends on the service. The Giving Block charges a 5% fee for every donation in addition to a monthly or annual subscription. Other crypto donation tools like Infinite Giving and exchanges like Coinbase and Gemini are free to use and charge around 0.5% to cover crypto network and conversion fees.

Are there cryptocurrencies that we should avoid?

All cryptocurrencies, including stablecoins, are subject to volatility. It's ok to accept any cryptocurrency supported by your exchange or crypto donation tool as long as it has a large enough market cap to ensure liquidity so you can convert to fiat (USD) immediately.

If you want to be extra cautious, you can choose to accept only the top cryptocurrencies right now, such as Bitcoin, Ethereum, USDC, and Litecoin. These are the most popular for crypto donations.

Start Tapping Into Crypto for Nonprofits

It’s an exciting time for nonprofits to explore new fundraising possibilities. Non-cash gifts like crypto offer the opportunity to secure significant, long-term support for your organization’s cause, and encouraging non-traditional donors to become a part of your mission can create a stronger community of supporters.

As you navigate this new terrain, Infinite Giving is here to help. Our platform allows you to increase your nonprofit’s funding without overburdening your team. Simplify cash management, investments, and complex donations with seamless technology and expert stewardship.

For more information, check out these additional resources:

- Crypto Donation Platform for Nonprofits | Infinite Giving. Learn more about the Infinite Giving crypto donation platform and how it helps you simplify and expand your fundraising.

- How to Accept Stock Donations: The Ultimate Nonprofit Guide. Curious about other non-cash giving options? Check out this guide to stock donations.

- Nonprofit Asset Management: Basics, Benefits, & Options. Managing, investing, and stewarding your organization’s funds is vital to secure its financial future. Learn the basics of nonprofit asset management.

.png)

DISCLOSURE

Infinite Giving Technologies, Inc. | Infinite Giving Advisory Services is a registered investment adviser in the States of Georgia, California, Colorado, North Carolina, Pennsylvania, and Texas. Advisory services are only offered to clients or prospective clients where Infinite Giving Advisory Services, Inc. and its representatives are properly licensed or exempt from licensure. Our firm may not transact business in states where it is not appropriately registered, excluded or exempted from registration. This content is solely for informational purposes. Past performance is no guarantee of future returns.

Investors’ experiences may vary from the content. Nothing in this content constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Infinite Giving manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary.

Individualized responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Investing involves risk and possible loss of principal capital. No advice may be rendered by Infinite Giving Advisory Services, Inc. unless a client service agreement is in place. Donation services provided by Infinite Giving Technologies, Inc.

Explore More

Ultimate Guides

Articles

Grow Your Giving with Expert Nonprofit Financial Advice